Credit Cards

A credit card is a thin rectangular piece of plastic or metal issues for the financial Institutions, a payment card issued to the user (also known as the Cardholder), that lets you borrow funds from the desired limit to pay for your purchases. Credit card charges are made against the line of credit instead of the account holder’s deposit.

Most payments in the Netherlands are done with Cash or Internet banking transactions. Credit Cards in the Netherlands are mainly used for Travel, International hotels, and Car rental bookings. Also, booking flight tickets and online purchases with a Credit Card gives more consumer protection in the Netherlands as compared to other mediums.

In the Netherlands, Credit Cards use the Chip and Pin System where you have to enter the pin for making payments in retail outlets and the contactless payment option is also there for transactions under €50.

Although Credit Cards aren’t in wide use in the Netherlands, Master card and Visa cards are widely accepted in the whole Netherlands’ retail shops. Including widely accepted Master Card and Visa cards, we have come up with the Top ongoing Credit Card Companies that are working in the Netherlands.

(Note – American Express Cards and Government-issued Cards are the only Credit Cards that are in range and use in the Netherlands and below mentioned are the types of AMEX cards.)

American Express Cards

American Express cards are active in the Netherlands but not as much as the Master cards and Visa cards are but, AMEX provides many in-house reward programs with the earned coins which becomes more flexible under the partnership with Travel and Airline agencies. You can transfer your membership Reward Points to your chosen program.

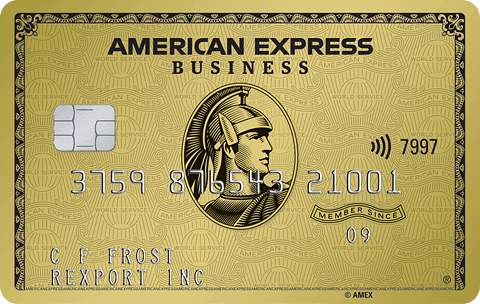

American Express Business Cards

If you have a running business and want to have a Credit Card, then American Express Business Cards will be the best choice. Here, two types of cards are issued to you which will be free for the 1st year. Only you need to show the number to the Dutch Chamber of Commerce and must have 1 year of registered Business.

What are the Benefits of American Express Business Gold Cards?

- Take advantage of a payment term of up to 50 calendar days.

- There will be no (cash) payments during the month, only one monthly payment.

- There is no predetermined spending limit.

- Your purchasing power changes based on your profile, current spending habits, and payment history.

- Each calendar year, the first $150,000 in combined purchases from these two categories earns 4X points (1X point per dollar thereafter).

- Purchase plane tickets directly from the airlines.

ABN Amro Credit Card

ABN Amro Credit Cards are the government cards issued by the Government with very good banking and Expat services. The best thing about the ABN Amro Credit Cards is that they provide credit card statements on paper every month and also you can check the transactions online or through your pin.

ABN AMRO Credit Card Local

- Mastercard and Visa Card

- Costs: € 1.70 per month

- Cash advance: 4% per withdrawal

- Exchange rate mark-up: 2%

- Purchase guarantee: 180 days

- Spending limit: Up to € 5,000

- Payment term: 21 days

A Gold card costs € 3.60 per month and includes a 365-day purchasing guarantee.

ABN AMRO Credit Card Overseas

- Free cash withdrawal in euros

- 4% (minus € 4.50) + 2% exchange rate surcharge per withdrawal in foreign currency

- Euro payments: Payment in Euros is free, however if you do Payment in foreign currency there is a 2% exchange rate surcharge each payment

ASN Credit Card

Ethical Bank (ASN) offers branded Visa Credit Cards that are issued by ICS where, each time you use the ASN card, there will be the automatic donation of 0.25% to a sustainable or humanity project which makes it a good sign to be the choice among different Government Credit Cards.

ING Credit Card

ING provides free bank accounts to students, children (up to the age of 12), and teenagers (up to 18 years old). In addition, for a nominal cost, you may personalize your own debit card with a variety of distinctive designs.

ING, on the other hand, imposes rather hefty fees for overdrafts and foreign cash withdrawals.

ING Credit Card Local

- Mastercard

- Costs: € 1.55 per month

- Cash advance: 4% and a minimum of € 4.50 per withdrawal

- Exchange rate mark-up: 2%

- Purchase guarantee: 180 days

- Spending limit: Up to € 5,000

- Payment term: fixed date

A platinum card costs € 52.20 p.a. with a purchase guarantee of 365 days and a spending limit of up to € 20,000. A student credit card costs € 13.80 p.a. with a spending limit of up to € 1,000

ING Credit Card Overseas

Credit card

The credit card

- Cash withdrawals in euros are subject to a 4% fee (minimum of € 4.50) each transaction.

- Cash withdrawal in foreign currency: 4% (minus € 4.50) + 2% exchange rate fee per withdrawal

- Euro payments: Payment in Euros is free, however if you do Payment in foreign currency there is a 2% exchange rate surcharge each payment.

Visa and Mastercard

Unlike other, Visa and Master Cards don’t provide Credit cards but go through member financial institutions. Both companies act as the middlemen between the person, the bank, and the retailer by handling the transactions on the Credit, Debit and Prepaid Cards. Visa and Master cards are the two biggest processing networks worldwide that provide bumper offers and rewards for payments.

The Netherlands is a Cash country where Dutch people majorly use Cash or Online Transactions to make payments. They are less friendly for Credit Cards and only in some parts or for online portals and retails shopping, Credit Cards are in use as they are less in debt score.