“Balancing your money is the key to having enough of it.”

Living in a whole different nation than yours and trying to build a life there is bit of a task. Anyone living independently, far from their hometowns can’t agree more. Expats are always in a struggle between spending and saving and yes, it’s really complicated!! If you don’t focus on saving you may lose a lot. Some have their focus on saving but they may not be doing it right. Having good knowledge about what your money is doing for you is the key to survival as an expat in Netherlands.

Few tricks for expat finance management

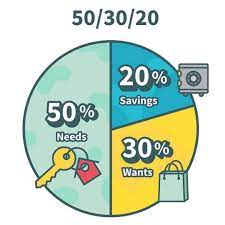

The 50/30/20 rule

This rule is as simple as its name. Here 50 says, meet your needs with 50% of your after-tax income. All the expenses on the things you actually need must be done with amount in the 50% box. After daily expenses come some fun, shopping, a meal out or anything in your wishlist.

Fun, shopping and other expenses are somewhat important for your mental peace. But with fun comes the savings bucket. Saving money is like saving your life. You must always save 20% of your income in any form, maybe a savings account, provident fund or investment, it will help you run long and far.

Pro tip: turn down spending 30% income on wants by saving 30% of income and spending only 20%. That can make life lot easier!!)

You must have a budget

Most people resist having a budget because most of them prefer not to go that way. The don’t want to go over their expenses, maybe its kind of boring to list out all the expenses, add up the numbers and follow those numbers. It might seem boring but it is best to have a track of your money. You can create your budget in few simple steps:

- Note down your net income.

- Write down all the expenses.

- Set monthly goals.

- Change a few spending habits if it doesn’t come in your budget bounds.

- Prioritize saving over spending.

- Make sure you follow it and you are good to go!!

Some of the Budgeting apps that you can take help from are Mint, Personal Capital, PocketGuard and Zeta.

Start building funds

If you are a farsighted-person you must have come across the thoughts about your future. How will it look in next 10 years? How will it look when you retire? What if an emergency comes up when you need a lot of money? All these questions running inside your brain can be answered by just a simple word, “funds”. You should try to add money to the various funds you have made. Like that travel fund, an emergency fund for some medical emergency or some other money related emergency, a retirement fund can help in a long run. It is said, “you are never too late to start a retirement fund” and it is the most appropriate thing to do.

Think twice before a big purchase

If you are thinking to purchase something big, that might end up in emptying your pockets you must first research on it. You should shop around and compare the quotes you find. You should look for both online prices as well as in-store prices. This might take investment of your time but it will be worth it once you find great deals and end up in saving thousands.

Pay for bigger loans first

If you are in debt or having multiple loan accounts, then to avoid getting into trouble you must analyse which account is lending you more money. You must check where you need to pay large amount of money or which account is charging more interest on the given amount. Then, you should pay in bigger amounts so as to get rid of the loan as soon as possible and then progressively you can repay others also. Since, with time the amount is going to get bigger. So, the sooner the better!!

Having financial awareness is always going to help you in best possible ways and you will never be short at money (you never have to call home for money, isn’t that cool!!!)

Read More: Trend “Why Netherlands attracts international students?” [Top 5 reasons]